Your Scenario

Cash-Out at Year 5

$51,466

New Properties

Acquired

1

Year - 10 Equity

$328,634

ROI on Intial Cash

476%

Year - 5 Cash-Out

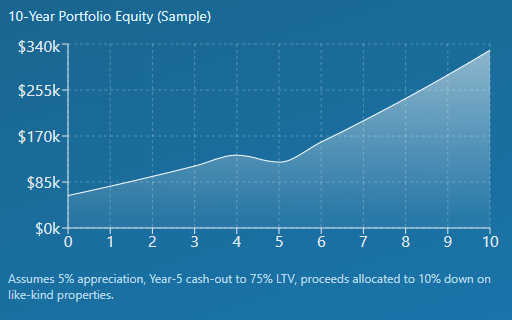

Year | # Properties | Portfolio Value | Debt | Equity |

|---|---|---|---|---|

0 | 1 | $300,000 | $240,000 | $60,000 |

1 | 1 | $315,000 | $237,788 | $77,212 |

2 | 1 | $330,750 | $235,403 | $95,347 |

3 | 1 | $347,288 | $232,834 | $114,453 |

4 | 1 | $364,652 | $230,065 | $134,586 |

5 | 2 | $642,884 | $521,163 | $121,721 |

6 | 2 | $675,029 | $516,119 | $158,909 |

7 | 2 | $708,780 | $510,697 | $198,083 |

8 | 2 | $744,219 | $504,868 | $239,351 |

9 | 2 | $781,430 | $498,603 | $282,827 |

10 | 2 | $820,502 | $491,868 | $328,634 |

Year-by-Year Snapshot

New Purchases at Year‑5 (10% Down)

Initial Purchase Cash to Close

Down Payment

$60,000

$9,000

Closing Cost

Total Initial Cash

$69,000

How This Works

-

Buy an investment property with DSCR financing (inputs at left).

-

Property appreciates at 5% per year by design.

-

At Year 5, we model a cash‑out refi to 75% LTV; proceeds net out refi costs and the remaining balance.

-

Use net cash‑out to fund 10% down on additional like‑kind properties (plus closing costs). We model loans for the new properties at the refi rate.

-

All properties continue appreciating at 5% through Year 10; chart shows portfolio equity over time.

Model excludes rent/NOI, taxes, insurance, maintenance, DSCR qualification impacts, and income tax effects. For lending, program eligibility and terms apply.

Ready to map your Investment path?

Get a personalized strategy with rates, DSCR, and leverage tailored to your market.

Frequently Asked (Investor) Questions

What DSCR do I need to qualify?

Most programs target DSCR ≥ 1.00–1.10×, but guidelines vary. We’ll tailor structure and pricing to your scenario.

What if rates change before Year‑5?

This is a planning model. Actual refi proceeds depend on rates, LTV limits, and your property’s appraised value at the time.

Can I 1031 instead of cash‑out?

Different strategy and tax treatment. This tool focuses on cash‑out refi to seed 10% down payments.

Can I change appreciation from 5%?

We’ve locked it to 5% for this landing page. We can customize a pro version with scenarios.

Disclosures

This is an educational estimator. Results are hypothetical and not a commitment to lend. DSCR, credit, reserves, prepayment penalties, state restrictions, and investor eligibility apply. Equal Housing Lender.